There are only 4 high level steps to get an active Maryland Home Improvement license from the Maryland Home Improvement Commission. This short article will walk through each of the steps and explain the details that tend to be confusing if you're getting licensed for the first time.

Click on the section to skip to that section:

- Prepping for the Home Improvement exam

- Setting up your business structure and registration

- Proving financial solvency and purchasing insurance

- Providing a background check

The 4 Steps To Get Your Maryland Home Improvement License

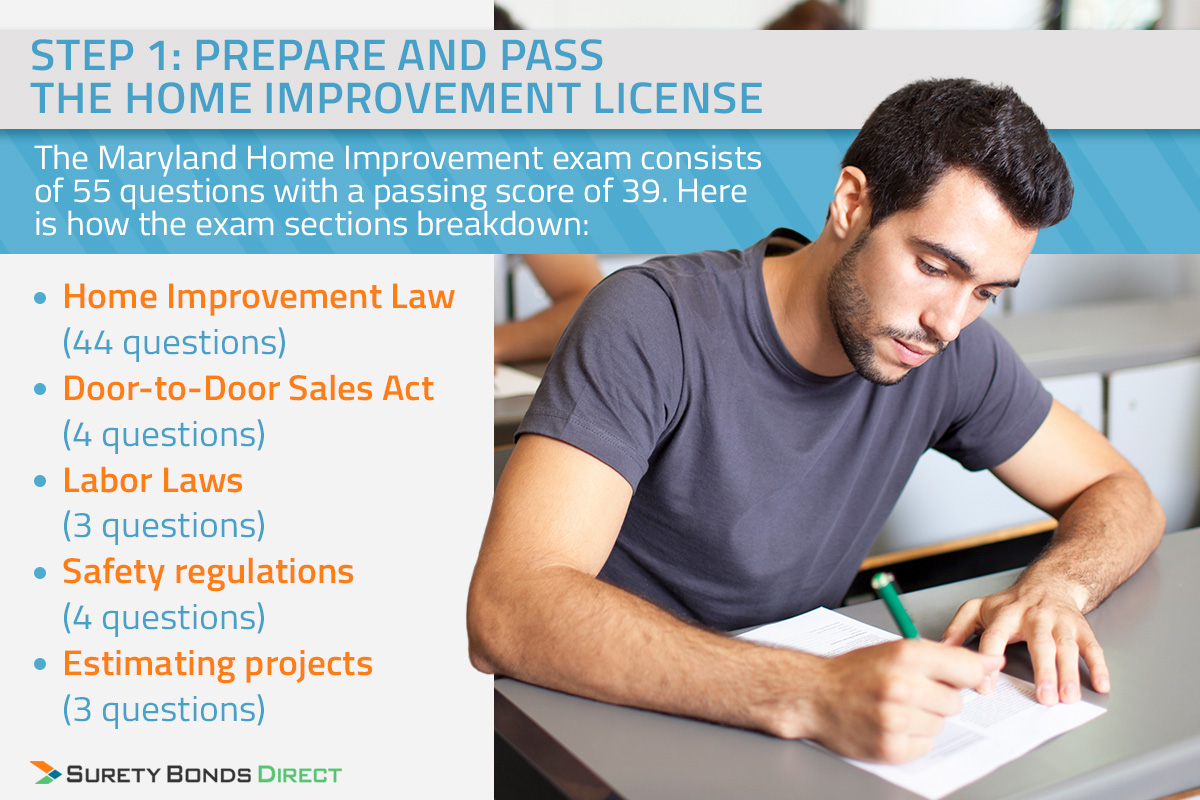

Step 1: Prepare and Pass The Home Improvement License

You must pass the exam before you can complete the license application package.

The Maryland Home Improvement exam consists of 55 questions with a passing score of 39. Here is how the exam sections breakdown:

- Home Improvement Law (44 questions)

- Door-to-Door Sales Act (4 questions)

- Labor Laws (3 questions)

- Safety regulations (4 questions)

- Estimating projects (3 questions)

There are many local community colleges that provide an exam preparation course, plus several online courses you could take.

Once you have your passing score, you can complete the rest of the application steps.

Step 2: Setup Your Business Structure and Registration

Determine how you will structure your business for licensure because you must identify a designated or qualifying individual.

A designated or qualifying individual is the person responsible for passing the exam and becoming the license holder.

If you're a sole proprietor, you are the qualifying individual.

If you're part of a corporation or LLC (limited liability company) you must designate this person.

With your application, corporations and LLCs you must also provide:

- Articles of incorporation (corporation)

- Articles of organization (LLC)

- Certificate of good standing filed with the Maryland Secretary of State

Registering a Business Trade Name

If you choose to register a trade name for your business, make sure you contact the Home Improvement Commission first. The Commission does not allow duplicate trade names to be registered, so make sure the name you want to use is available.

Once you find an available name, you will register with the Maryland Department of Assessment and Taxation.

Step 3: Prove Financial Solvency and Purchase Insurance

What is the Guaranty Fund?

The Home Improvement Commission manages a Guaranty Fund.

Every newly licensed contractor must pay $100 into the fund and on every 2 year renewal of the license, you must pay $150 into the fund.

The purpose of the fund is to provide a level of financial protection to customers of all licensed contractors in Maryland.

If a contractor purposefully and financially harms their customers, the customer can make a claim to the Guaranty Fund for financial compensation. The maximum level of compensation available for any contractor job is $30,000.

Examples of fraudulent actions include:

- Not completing a job according to the contract

- Not starting or fully completing a project

- Using poor workmanship or falsifying materials

- Not paying subcontractors and sticking project owner with the bill

Why Prove Your Financial Solvency?

If a contractor is found guilty of a valid claim, the Guaranty Fund will pay the customer. The guilty contractor must pay the Guaranty Fund back the amount of the claim.

This is why the Home Improvement Commission requires a net-worth (or financial solvency) of $30,000. They want to know the contractor can pay the fund back in the event of a valid claim.

What If You Can't Show a $30,000 Net-Worth?

If you're unable to show a net-worth of $30,000, you can purchase a surety bond or contractor bond.

If you submit your financials with a credit report showing your financial standing, the Home Commission only requires you to purchase a surety bond in the amount of $30,000.

If you elect not to provide any financial documents or a credit report, you can purchase a $100,000 surety bond.

| Bond Type | Bond Amount | Condition | Get Pricing |

|---|---|---|---|

| Home Improvement Bond | Provide financials | $30,000 | Get Pricing Fast |

| Home Improvement Bond | Do not provide financials | $100,000 | Get Pricing Fast |

A surety bond is a type of insurance purchased for the protection of a third party.

In this case, you purchase the surety or contractor bond for the protection of the Guaranty Fund. In the event of a valid claim, the Guaranty Fund will make a claim against the surety bond to reimburse the fund.

Keep in mind, these bond amounts are not the price to purchase the bond. The price is a small fraction of these amounts.

Learn the details of the Maryland Home Improvement contractor bond and purchase your today.

Purchase General Liability Insurance

All licensed contractors are required to show a general liability policy with minimum coverage of $50,000.

Liability insurance covers any injury sustained by the project owner (or other non-business related individuals) while on the job site.

While not required by the Home Improvement Commission, if you have employees, it's a good idea to purchase workers compensation insurance in the event an employee gets injured while on the job site. You may also be required to purchase workers compensation in accordance with other state laws.

Step 4: Background Check

You must report any conviction that resulted in a felony since January 1, 1991.

For any occurrence you must provide all relevant information from the clerks office. The Commission considers:

- The nature of the crime

- The nature of the crime and how it relates to licensing activities

- The nature of the crime and how it relates to the contractor industry

- The length of time since the conviction

- The post conviction behavior

Having a prior conviction does not mean you can't get licensed.

Application Notes

You will need to provide a recent (within 90 days) credit report from one of the big three credit agencies. Remember, you can opt out of this by purchasing a $100,000 contractor surety bond.

Maryland does not offer any type of license reciprocity. This means, if you have a similar license from another state, you can't use your experience to waive the exam or license requirements.

All out of state contractors must complete the Home Improvement license process and register with the Maryland Department of Assessments and Taxation.

Home Improvement Salesperson License

The Home Improvement Commission also licenses salespeople or business solicitors for home improvement projects.

The process is similar:

- Pass the salesperson exam

- Complete the application package

- Prove employment for a licensed salesperson or contractor

There is no financial solvency, bonding, or insurance requirement for the salesperson license.

A licensed salesperson can only be employed and represent one licensed contractor at a time.

We'll Help You Get Bonded If You Choose This Option

I hope this article answered any lingering questions about getting a Maryland Home Improvement license.

The Commission has a lot of great information on their website, but they don't fully explain what the bonding process is, especially if this is your first time getting licensed.

If you choose to purchase the $30,000 bond or the $100,000 bond, request a free quote today using our online quote form. It takes only 90 seconds and we'll provide an exact price within one business day.

If you prefer, you can call a bond specialist at 1-800-608-9950 and they will help you get the quote process started.

We will price shop for you and find the lowest cost. So act today and get this process done.