What Is a Probate Bond?

Fiduciary bonds for executors, administrators, guardians, and trustees.

Probate courts often require executors, administrators, trustees, and legal guardians to obtain surety bonds to ensure that appointed individual upholds her/his fiduciary responsibility.

In the United States, the will of a deceased individual is processed through the probate court system. A probate court helps to determine how the instructions in a deceased person's will should be executed, how the deceased person's debts should be settled, and who will be responsible for carrying out these tasks. Administratorship, legal guardianship, and trusteeship are all processes related to the aforementioned responsibilities, and many are also settled in probate court.

All of these legal processes can be complex, time-consuming, and emotionally charged, and they can affect the well-being of many other individuals. For these reasons, probate courts often require executors, administrators, trustees, and legal guardians—positions which are sometimes collectively referred to as fiduciaries—to obtain probate surety bonds that guarantee their performance of their required duties.

Surety Bonds Direct is a leading source for probate bonds of all types, and we use our expertise to help our customers find the surety bonds that suit their needs at an affordable price. In this article, we'll examine the many different types of probate bonds, how they work, and key facts to know about each type of bond.

Please note that nothing in this article constitutes legal advice. For anyone unsure about their or someone else's duties as an administrator, executor, guardian, or trustee, consulting an attorney is always the best option.

Understand Probate Bonds & the Basics of the Probate Process

First, it's important to know how the probate process works. A will allows a person to leave instructions about how their possessions will be distributed and dependent family members will be cared for after the writer of the will (called a testator in legal terms) passes away. The probate court system is responsible for executing the instructions in a will and settling any disputes that may arise.

Typically, the process followed in probate court includes these steps:

- The will of the testator must be found, authenticated, and filed with the probate court.

- An executor or personal representative must be appointed, either by instructions in the testator's will or by the court.

- The testator's property must be located, accounted for, and appraised.

- Any debts owed by the testator must be settled using the testator's assets.

- Estate and property taxes on the testator's property must be paid to federal and state governments.

- The testator's property must be distributed to the beneficiaries of the will.

Other legal processes that can be conducted in probate court, such as guardianship and trusteeship, have different and specific requirements that vary widely by state and by circumstances. For any kind of probate process, however, one requirement that many courts impose is that the executor, administrator, guardian, or trustee obtain a probate surety bond.

What Is a Probate Surety Bond?

So, what is a probate bond? Our article What Is a surety bond? provides a quick guide to the basics of surety bonds. Once you understand the major concepts behind a surety bond, it's simple to determine how these concepts apply to a probate bond:

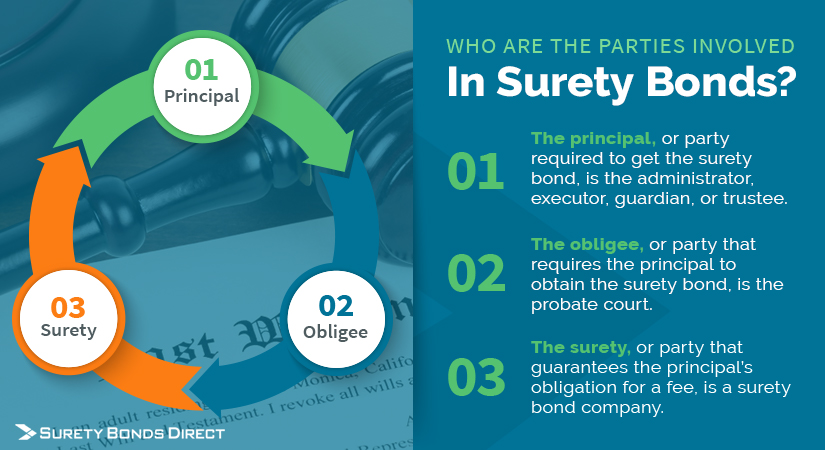

- The Principal

- the party required to get the surety bond, is the administrator, executor, guardian, or trustee.

- The Obligee

- The party that requires the principal to obtain the surety bond, is the probate court.

- The Surety

- The party that guarantees the principal's obligation for a fee, is an insurance or surety bond company.

A probate surety bond guarantees that the principal will fulfill their duties and obligations under the law and the testator's will. In the event that the principal fails to fulfill part or all of their duties (whether through negligence or intentionally), the court or a wronged party can file a claim against the principal's probate bond to receive financial compensation up to the bond amount. If the surety decides that the claim is valid, the principal is responsible for paying back all the money that the surety has paid to the claimant.

Types of Probate Bonds

Several different types of probate surety bonds exist:

Each type of probate bond or fiduciary bond is designed for a different type of probate function. In the next sections, we'll examine each type of bond and what any surety bond buyer needs to know before purchasing one. However, take note of two important considerations when learning about probate bonds.

First, it's important to clarify that probate bonds are not the same thing as bail bonds. Although both are types of bonds required by courts, a bail bond is a bond posted to secure an individual's release from incarceration before their trial and is totally unrelated to the probate court system. Surety Bonds Direct does not sell bail bonds.

Second, when applying for any kind of probate surety bond, be aware that the bond buyer will need to provide the court with a list of all of the estate's assets and liabilities, as well as any court documents associated with the probate case. This information helps the court to determine the premium rate that the buyer will pay for the probate bond. Thus, if the deceased individual's assets haven't been fully accounted for yet, that task will need to be completed before the buyer applies for a probate bond. Cash will presumably be distributed upon settlement, but in the case of a minor, an incompetent or an additional trust agreement, the assets may be distributed over time. Although this is a rare occurrence, in some counties, the court will ask the individual to provide a bond amount based on assets or the will.

Executor Bonds

For most people, naming an executor is a key part of creating a last will and testament. The executor of the will is the person appointed to carry out the testator's wishes as described in the will. Spouses, children, and siblings are all often appointed as executors, but nearly any person over 18 can typically be appointed as executor by the testator (although some state laws specifically exclude those convicted of a felony).

Being the executor of a will grants an individual the legal authority to perform tasks such as distributing property and paying off debts for the deceased. Requirements such as settling of debts and estate taxes must be taken seriously, and an executor bond provides a financial guarantee that these tasks will be performed and executed faithfully.

The testator may decide to add a probate bond waiver to their will, freeing the executor from the responsibility of obtaining an executor surety bond. Waiving the executor bond is usually done when the executor is someone, such as a spouse or child, that the testator trusts completely. If the will does not specify whether or not an executor bond is required, the probate court can choose whether or not to require one.

The bond amount of an executor bond is set by the court or by the will and is usually determined by the value of the testator's estate. The premium that the executor pays, however, is also affected by several factors, including the principal's credit and financial history. Finally, different states have different laws regulating executor bonds, so be sure that the bond you need matches your state's laws by entering the correct state when requesting a probate bond quote from Surety Bonds Direct.

Administrator Bonds

Sometimes, an individual dies "intestate" or without a will. Other times, a testator leaves a will that does not name an executor. In still other cases, an executor declines to serve or dies before the testator does, and the testator does not name a replacement. In these cases, the probate court will often appoint an administrator to handle the estate. Typically, the deceased's surviving family is asked to name an administrator; if the family cannot agree on an individual, the probate court will appoint one.

An administrator performs similar functions as an executor and controls any assets of the estate. Administrators are responsible for paying the deceased's debts, making funeral arrangements for the deceased and distributing any remaining assets of the estate. Requirements for administrators vary widely among U.S. states and are determined by each state's laws of intestate succession.

An administrator surety bond serves a similar purpose to an executor bond. Administrator bonds guarantee that the administrator will fulfill their legal and ethical duty in settling the debts and distributing the assets of the deceased individual. Much like an executor bond, the probate court will set a required bond amount for an administrator bond.

Guardianship Bonds

What is a Guardianship Bond? Many individuals use their wills to establish who will take care of their minor children or other dependents, such as people with disabilities, after the testator passes away. Establishing legal guardianship of a minor or a disabled person is another legal process that's carried out through probate court. Since the guardianship process gives the legal guardian considerable power over a potentially vulnerable person and over their finances, the guardian is often required to obtain a surety bond for guardianship.

Guardianship surety bonds, which can also be called conservator bonds or custodial bonds, ensure that the legal guardian will fulfill their legal duties and behave ethically. Like other types of probate bonds, the cost of a guardianship bond can vary greatly by state law, by the bond amount imposed by the probate court, by the size of the testator's estate, and by the circumstances of the minor or incapacitated individual. To get an easy two-minute quote for your guardianship bond, contact Surety Bonds Direct today.

Trustee Bonds

A trust is a different kind of legal construct for managing a person's assets after they die. A person who creates a trust is called the trustor or grantor, and the individual who takes control of their assets is called the trustee.

Trusts are similar to wills but have a few important differences. Some types of trusts transfer property directly to a beneficiary upon the trustor's death or even before, bypassing probate court entirely. However, trusts also have their limitations, such as the inability to specify care arrangements for a minor child or a disabled adult.

Numerous different options are available for creating a trust, including revocable trusts, irrevocable trusts, charitable trusts, special needs trusts, and many others. Anyone thinking of forming a trust or who may become a trustee should be sure to learn the details of their obligations under the specific type of trust before they take on their responsibilities as trustor or trustee.

Because trusts offer some advantages in simplifying the probate process, they are a popular option for many individuals when making end-of-life plans. However, it's important to plan a trust with the assistance of an estate planner or probate attorney so that everyone involved understands the precise conditions and legal requirements of the trust.

To take control of a trust, a trustee may first be required to get a trustee surety bond. Like other types of fiduciary bonds, a trustee bond guarantees that the trustee will faithfully execute the conditions specified by the law and by the trustor's instructions and will not engage in dishonest or deceptive practices. Surety Bonds Direct offers quick and affordable online quotes for trustee bonds.

Probate Court Bonds from Surety Bonds Direct

Surety Bonds Direct believes that getting a surety bond for probate court shouldn't have to be a long or confusing process. We design our process specifically to make it as easy as possible for our customers to get the surety bonds they need for an affordable premium and to minimize the hassle and stress of the surety bond application process.

We work directly with AM Best A Rated sureties to find the best rates for our customers, and our proprietary system helps match customers with the perfect surety bond provider. Our surety bond experts will be happy to assist anyone with further questions about probate bonds. Just call us at 1-800-608-9950 or contact us online for a free, no-obligation quote on your probate bond.

Jason O'Leary

Jason O'Leary

updated: